Dear Ministers of the Environment

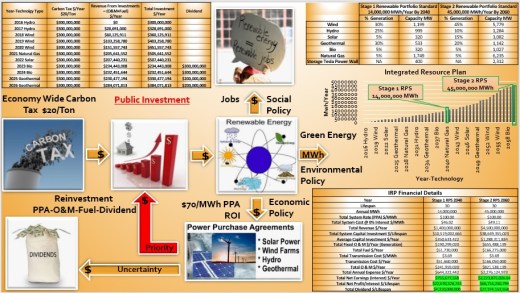

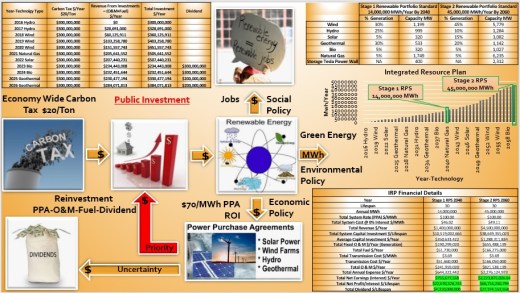

My name is Chris Rouse and I represent New Clear Free Solutions an environmental group based in New Brunswick. We have submitted both Provincially and Federally a carbon tax policy which publicly invests the carbon tax into renewable energy and continually reinvests a portion of the return on investment also into renewable energy until a renewable portfolio standard is reached. The reinvestment creates an ever growing amount of money to be able to transition to a very low carbon economy. This policy provides all of the capital needed to make the transition and changes the conversation from how much is this going to cost the Provinces to how much money can it make the Provinces.

In August 2016 the US Energy Information Administration released its 2016 Annual Energy Outlook. We have updated the Carbon Tax and Investment Plan using the latest cost and performance data from this report. The update also provides additional financial details and extended the detailed Integrated Resource Plan to include a 2060 Stage 2 Renewable Portfolio Standard for New Brunswick. This update also includes additional sensitivity analysis, and provides estimates for each Province and Territory and Canada as a whole.

Summary of Update

Link to full update

carbon-tax-and-investment-plan-2016-annual-energy-outlook-update

The Carbon tax will allow Canadians to invest in our abundant renewable energy resources with our provincially owned integrated electric utilities. This will stabilize our energy rates and provide billions each year in net profits for each Province. The transition to a low carbon economy is going to require billions in capital investments with an expected return on those investments. If the capital is debt financed or privately financed they will earn the billions in interest, if Canadians are allowed to invest, using the Carbon tax revenue, Canadians will earn the billions in interest. The decision to publicly finance or to private or debt finance the transition is arguably the most important decision that needs to be made.

I am happy to offer my assistance in developing a detailed integrated resource plan similar to the one I have prepared for New Brunswick for any of the Provinces or Territories. I would also like to offer a detailed presentation of the policy or answer any questions that you might have.

Best Regards

Chris Rouse

New Clear Free Solutions

1-506-650-0007

This powerpoint was originally made by Sharon Murphy from PEACE NB, for the Energy and Utility board’s hearings of NB Power’s request for a 2% rate hike in Jan 2017. However, the theme of the power point, that nuclear power is not economically sensible, is bigger than just the rate hearings. This presentation has been altered slightly from the original version which focused on rates. It is imperative that the New Brunswick public is informed as to where their money is going and how much of their money is being spent irresponsibly. This powerpoint was designed to be self explanatory so the message would be easy to understand without notes or a presenter.

This powerpoint was originally made by Sharon Murphy from PEACE NB, for the Energy and Utility board’s hearings of NB Power’s request for a 2% rate hike in Jan 2017. However, the theme of the power point, that nuclear power is not economically sensible, is bigger than just the rate hearings. This presentation has been altered slightly from the original version which focused on rates. It is imperative that the New Brunswick public is informed as to where their money is going and how much of their money is being spent irresponsibly. This powerpoint was designed to be self explanatory so the message would be easy to understand without notes or a presenter.